PayU Risk

Online fraud drives the large card networks to enact more regulatory measures to help mitigate potentially fraudulent transactions. To help you to comply with these market requirements, our risk service evaluates the risk probability of your transactions based on the information you collect from your shopper.

Availability Information

PayU Risk is a risk evaluation service for Card and Alternative Payment Method (APM) transactions. Verify your provider’s support of the feature by checking your Provider Integration Guide and filtering by Cards > Features > PayU Risk.Using the Risk Service

The most recommended and straightforward way to use our risk service is within your Create Authorization and Create Charge requests, i.e., as an embedded service. In this scenario, the risk evaluation is performed in the pre-authorization stage, after which PaymentsOS either calls the processing provider or cancels the transaction, according to the risk rules you pre-configured via your Decision Engine. To start using the service, follow these steps:

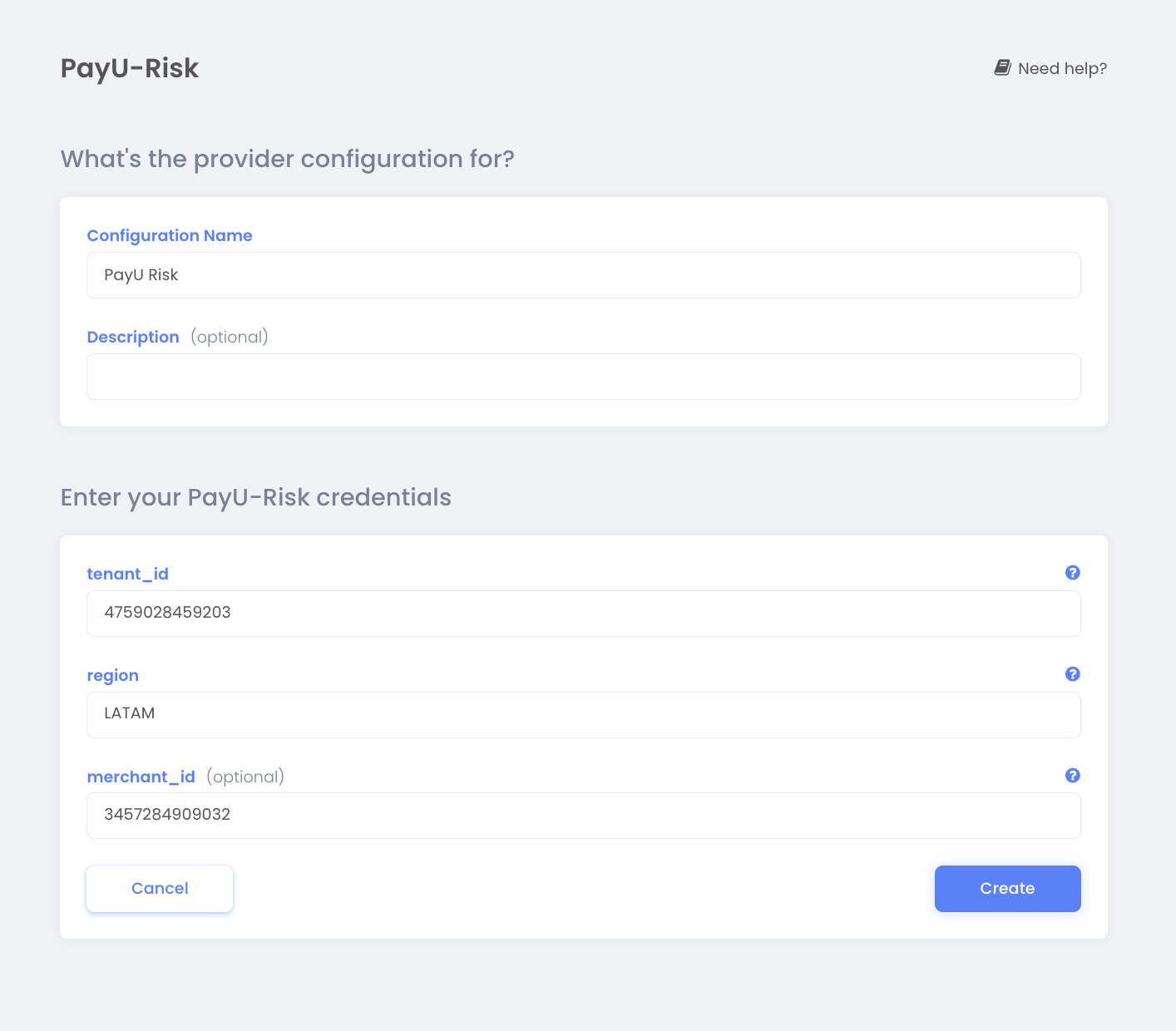

Step 1: Add PayU Risk as a Provider

Go to Account -> Providers -> ‘PayU Risk’.

Note about `tenant_id` and `merchant_id` fields

- The

tenant_idfield is mandatory and you should receive it from your account manager during the onboarding process. - The

merchant_idfield is optional, yet it is recommended to ensure that the risk team can set up specific country-based rules for LATAM countries. The credentials for this field are also received during the onboarding process, but you can always ask your account manager to fetch it for you.

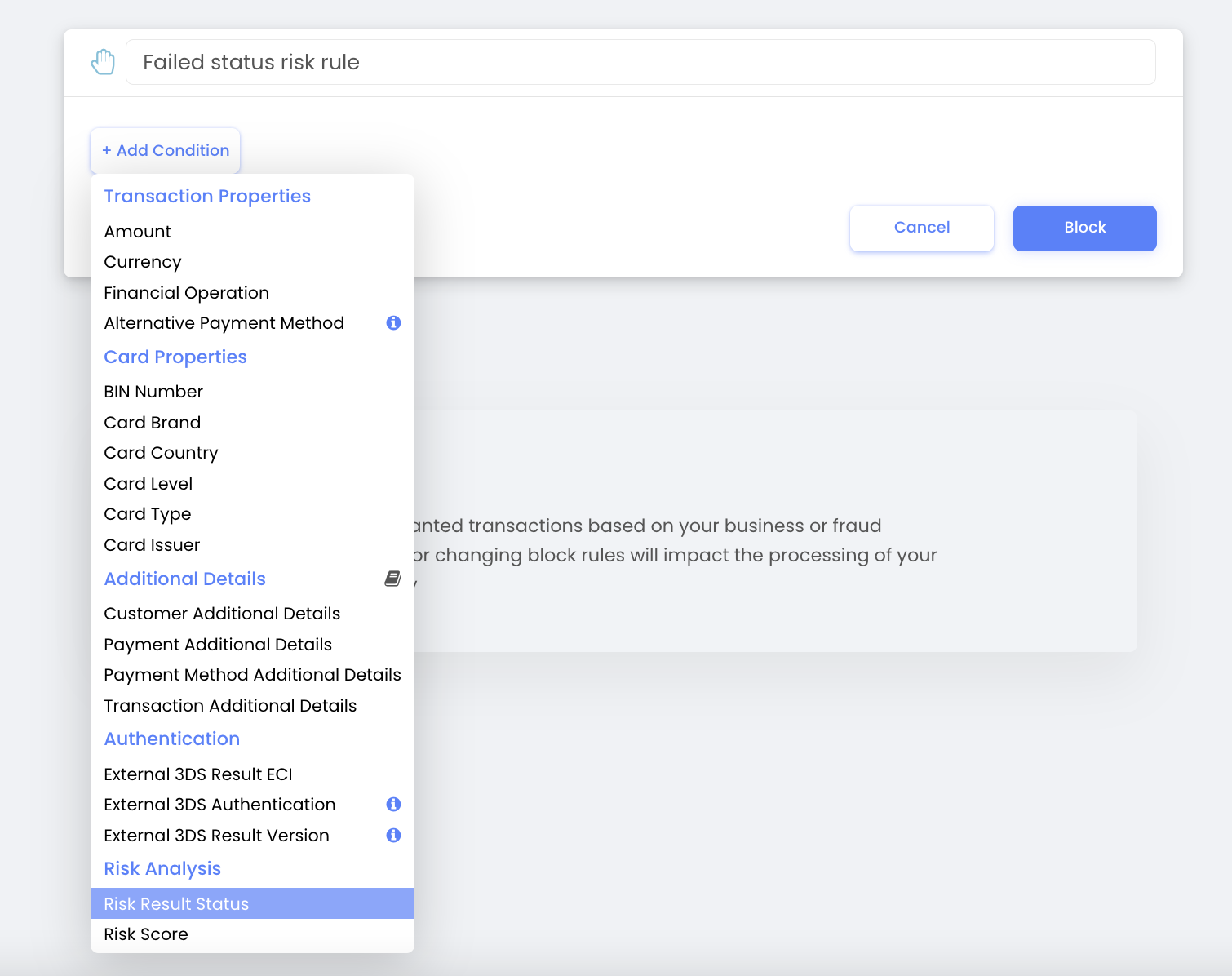

Step 2: Configure Blocking Rules Based on Risk Evaluation Result

The risk evaluation we provide is a recommendation only, meaning that you will need to decide whether to act upon it or not— and manually set blocking rules to prevent high risk transaction from being sent to authorization. Note that all transactions are sent to authorization by default, so our recommendation is to block all transactions that receive a ‘Failed’ risk status (See Risk Analysis Results evaluation via the decision engine, as demonstrated in the image below.

Step 3: Pass the Risk Configuration ID in the Request Header

To ensure transactions are reviewed and evaluated, you will need to pass the configuration ID (from your provider configuration) in your Authorization or Charge request header, under the x-risk-provider-config-id field:

x-payments-os-env: test

api-version: 1.3.0

x-risk-provider-config-id: 4efe54ff-5956-4df3-a295-b23c17836d21

private-key: bede7ee5-eaaq-4c9a-bc1f-617ba28256ae

app-id: com.zooz.docapp

idempotency-key: AGJ8FJLkGHIpHUTK

Step 4: Include Mandatory Risk Fields

To run a risk analysis, you will need to include several mandatory fields in your Create Authorization, or Create Charge requests. To generate sample requests that include these fields, use our Bodybuilder and make sure to check the box for Include risk fields before generating the request. Note that this option is disabled for providers where risk assessment is not supported.

Risk Analysis Results

PaymentsOS maps the result of the risk evaluation to one of the following statuses: Pending, Succeed, Failed, or Unreviewed.

-

Pending means that the transaction is undergoing risk evaluation review.

-

Succeed indicates that the transaction is approved and safe to proceed with.

-

Failed means that the transaction is (likely) fraudulent, and you are advised not to proceed with the authorization or charge requests.

-

Unreviewed indicates that the transaction hasn’t been reviewed. Possible reasons might be due to a missing Risk Provider Configuration ID from the request header, due to an API error, or in case of an unsupported Alternative Payment Method (APM).

Fetching the Risk Result

You can grab the risk analysis result by retrieving the operation you invoked initially to process the transaction, I.e., the Create Authorization or Create Charge requests.

{

"risk_analysis":{

"id":"f6b8938f-2f90-4c10-832b-027a8597f1e6",

"result":{

"status":"Succeed",

"score":0

}

}

}

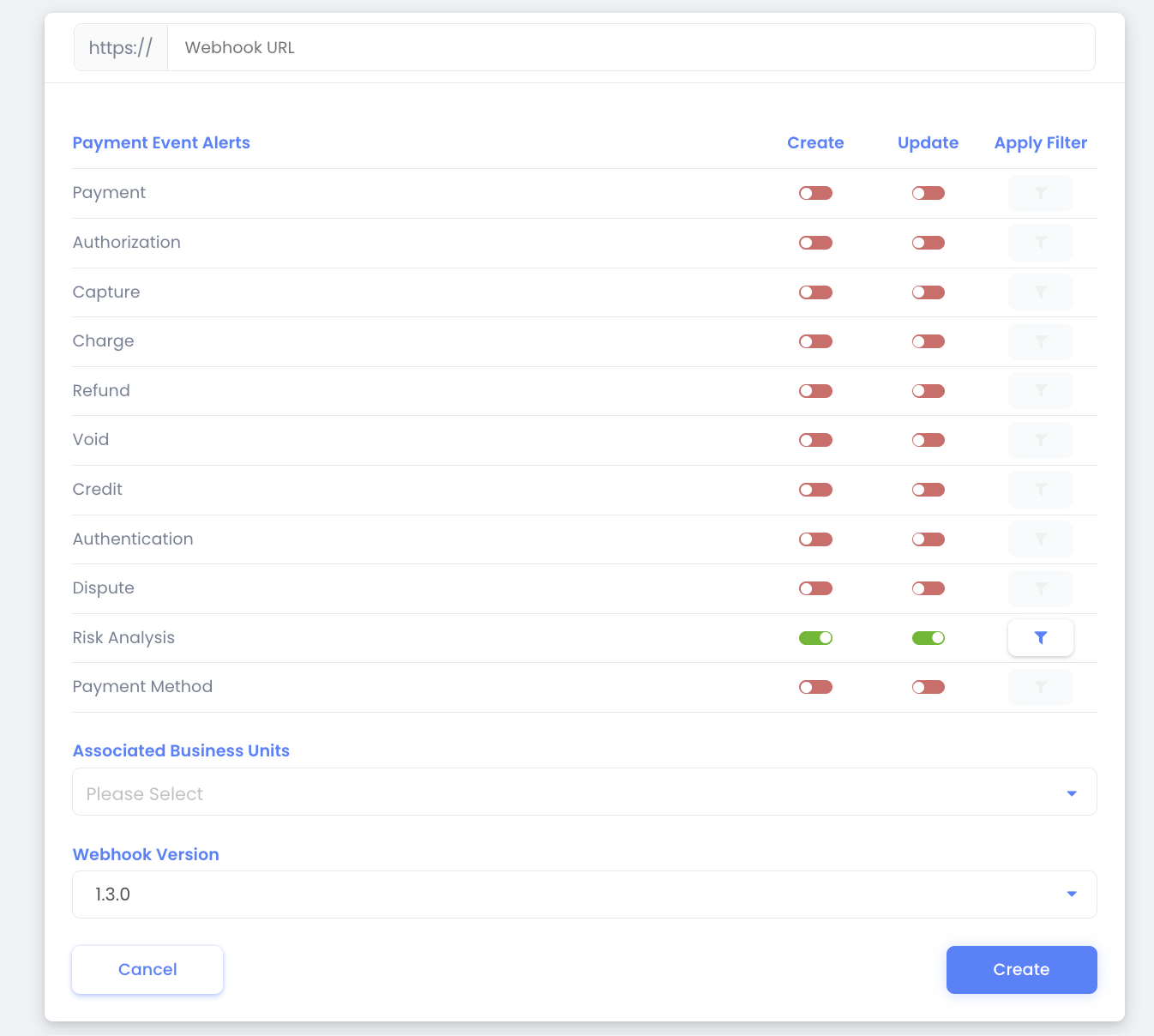

Webhook Notification of a Risk Status

To get notification when a transaction risk status is created or updated, you can configure webhook notifications via your control center (Account > Webhooks).